Can you grow a new heart?

There’s a question I love to ask:

What do you think the next trillion dollar industry will be?

I was once lucky enough to find myself talking with a former DARPA research scientist, and asked his thoughts on the question. And then he asked my opinion. I replied doe-eyed that I thought the next great industry would be “Space”. But he reminded me that (obviously) satellites have probably unlocked close to a trillion dollars in value already.

Guess there’s a reason I’m blogging and not solving cold fusion.

Anyway. I love this question, because it tells you a lot about what someone thinks the future is going to look like. It also implicitly tells you what they hope the future is going to look like.

Today, I want to share one vision of that future.It starts with the manmade nanocarbon infrastructure of 3D Biofibr.

Small but mighty (the future has arrived)

This is a company I’ve actually been following for a while, ever since they got picked up by the Creative Destruction Labs technology accelerator. Recently they’ve turned a milestone though, as Biofibr announced in July they’ve raised of a S3.25M seed round from Invest Nova Scotia, Build Ventures, Concrete Ventures, and Globalive Capital.

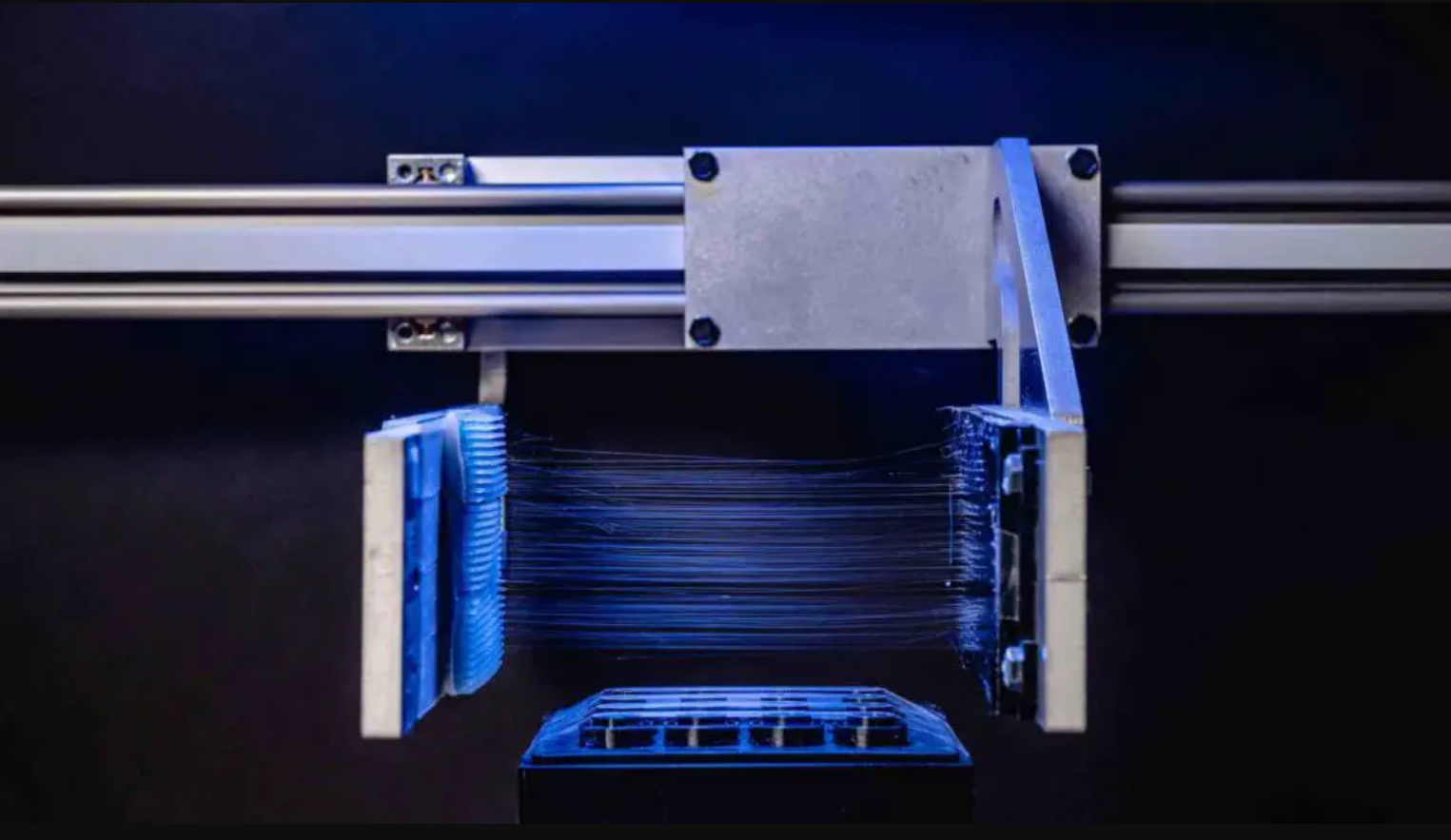

As the name might suggest, 3D Biofibr has developed technology to produce fibers of different biomolecules, such as proteins, collagen, and even spider silk.

Take a look at their Youtube channel if you want to see the technology in action. It’s pretty cool stuff. And they only have 23 subscribers so…give them a follow?

Definitely some West World energy here ngl

Now one of the reasons I wanted to talk about this company is because my answer to the “trillion dollar question” is that:

I think nanobiology will be the most important industry in the 21st century.

And, of course, just like my earlier answer, I’m not exactly ahead of the curve on that call either. But while mRNA vaccines might be cutting-edge in their own right, I personally can’t wait for the next wave of biomedical innovation. When we can reconnect spinal chords, cure genetic diseases, and even grow someone a new heart.

We’re not there yet.

But 3D Biofibr is working on it.

The State of Things

One of the things that will stand out to you right away when you’re on the 3D Biofibr website is…they’re already selling product.

A lot of their earlier press releases talked about “spinning silk” and various applications across defense, textiles, and of course pharmaceuticals as well. That broader scope isn’t necessarily a bad thing. Biological fibers have lots of applications. It’s natural to cast a wide net.

Now though, the company clearly has a vision for product market fit. They are trying to build and scale in the “cell scaffolding” space

From their website, you can buy some trademarked “CollaFibR™ Scaffold for Cell Culture” for the low low price of…$20?

Wait what?

I don’t know if it’s just me, but something about that price tag feels very…achievable?

And that’s because despite all my pie-in-the-sky scifi talk, “tissue engineering” is already a billion dollar industry. I quickly found several companies offering similar products marketed as “scaffolds” for cell cultures. And at least one of them is backed by a major pharmaceutical company. Wildly enough, 3D Biofibr even offers “additive collagen” for use in cell 3-d printers to maintain “shape fidelity” of “bioprinted constructs”

Awesome? Gross? Kinda both.

That brings us to the difficult question of who gets to win.

Pharma is built different (why intellectual property matters)

The funny thing about patents is sometimes they don’t matter at all.

I’m being inflammatory on purpose, but it’s kinda true. One of the biggest red flags in a software startup is a founding team that believes a “Software patent” is going to give them some huge advantage. In software, things just move too quickly, a patent is not a strong foundation for a business.

Pharma is kind of the opposite.

If you’re a research team developing a groundbreaking new drug or medical device, you will probably never have to actually sell your product. Once you have trials proving it works, you just sell the IP rights to a big pharma company that already has scale and distribution.

However, there is a dark side to this market structure. If the value of your business is what you own rather than what you do, the big dogs have no incentive to see you succeed. They’d rather destroy your dream, and pick up the pieces left over afterwards

That’s why I’ve heard a lot anecdotally about borderline-frivolous IP lawsuits from big Pharma companies. They can sue a promising new business, bury them in legal fees, and then swoop in with an acquisition offer.

At a discount of course.

A glimpse into the future

I have no reason to believe any toxic acquisitions are going to happen to 3D Biofibr. All I know is there’s already competition.

Interestingly, after clicking around their site for a bit, I received this pop up asking for feedback. And I found it very interesting.

This popup sets out the key concerns for a fight in the biomedical space:

Pricing

Specs

Familiarity

Customizability

This company knows that if they want to win, they have to play with the big dogs. That’s why one of the most parts of 3D Biofibr’s business right now is its leadership. Their CEO is Kevin Sullivan, an executive with decades of experience in high tech pharma.

He knows the pitfalls, he knows the tricks, and he knows what it takes to win. You have to meet your clients where they are, and provide real value today.

The truth is, there’s probably only going to be one or two winners in the nanobiology space. But those winners will control an enormous, and incredibly important part of the new world economy.

Those winners may be big pharma. They have been in the past. But you never know. Maybe this time, we’ll see the rise of a scrappy new entrant that knows the obstacles ahead, knows how to pivot, listen to their customers, and execute on the next trillion dollar market.

Maybe.

Only time will tell.

Until next time, this has been,

The Weekly One Pager

What will it take to change the global positioning system?